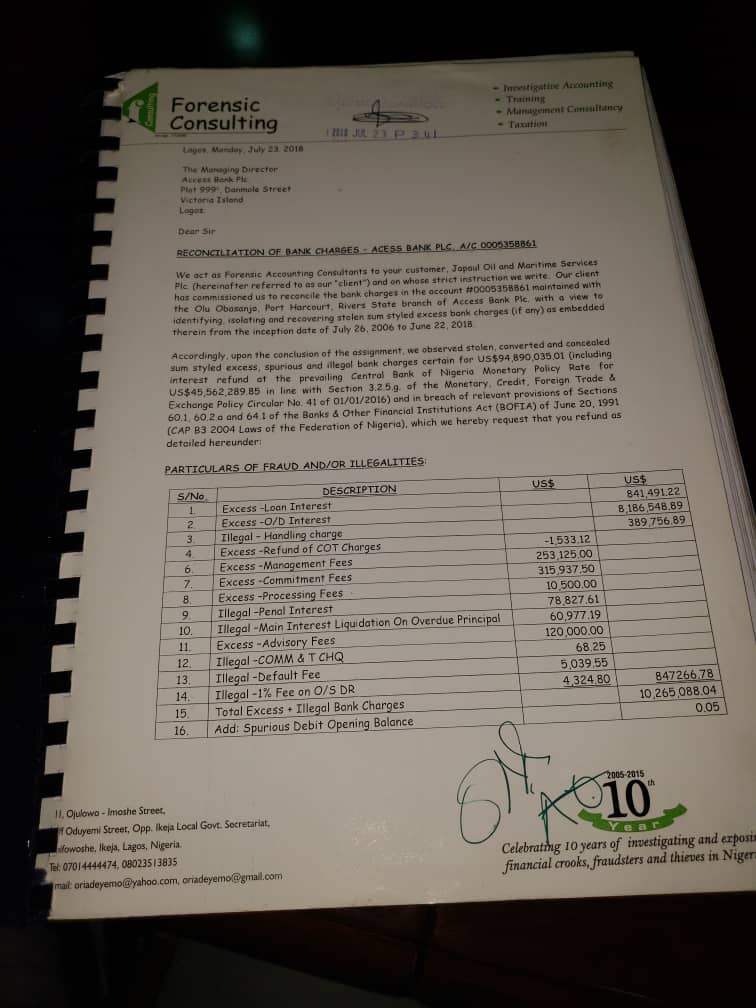

Following a forensic audit report obtained by Japaul which showed that Access bank had been posting excess charges and some illegal charges into Japaul facility accounts to the tune of 10 million American Dollars , Access bank has obtained an order to freeze all bank accounts belonging to JapaulPlc and its chairman.

According to our source, the total Japaul Dollar claims against Access bank will be around $94m as per dollar accounts audit.

The naira accounts audited also showed excess and illegal charges that amounts to N18.7billionJapaul claims against Access bank which include interest refund at prevailing CBN MRR/MPR of N9billion. The report covered 12 years transactions. These details are as contained in the forensic reports that has been submitted to the court and Central Bank of Nigeria.

Access bank alleges that about $25million is in debit against japaulPlc, the money ,it says was given to Japaul for the financing of three number dredgers and that there is a default on repayment of the total sum on the part of JapaulPlc whereas Japaul says it is not owing access bank given the current circumstances.

The State High Court reportedly directed the case to ADR (Alternative dispute resolution) at Igbosere for reconciliation of accounts and Mrs Godwill ,the Mediator has asked both parties to nominate an independent first rated auditor to reconcile the claims of the two parties.

It was however gathered that Access bank abandoned the Alternative Dispute Resolution and went to the Federal High court on the 29th January 2019 to obtain Mareva injunction to freeze JapaulPlc accounts despite the fact that the case is already in the State High Court and despite the fact that Mediator is already on that same case for reconciliation of accounts of both parties.

Some Legal practitioners have described this as abuse of court process and expressed hope that CBN will intervene as regulators since they were served a copy of the report.

The defendant Counsel ( ofJapaul) has filled a preliminary Objection to vacate the order and the case has been adjourned for ruling on the 30th April.

You would recall that there was a similar case between Innoson Motors and GTBank which ended in a claim by Innoson that it has obtained a nod from the court to take over Guaranty Trust Bank after a protracted court case.